Due to the passage of the “USA PATRIOT Act,” we are required to notify customers of the following information:

Federal laws and regulations require us to request information from you prior to opening an account or adding an additional signatory to an account. The information we request may vary depending on the circumstances, but at a minimum, will include your name, address, an identification number such as your social security or taxpayer identification number, and for individuals, your date of birth. We are also required to verify the information you provide to us. This verification process may require you to provide us with supporting documentation that we deem appropriate. We may also seek to verify the information by other means. We reserve the right to request additional information and/or signatures from you from time to time.

This Cardholder and Deposit Agreement, along with any other documents and agreements we give you pertaining to your (i) Challenger Mastercard® debit card (“Challenger Card”) and (ii) deposit account ((i) and (ii) are hereinafter called the “Account”) (collectively, the “Agreement”), is a contract that establishes rules that control your Challenger Card and Account. Both the Challenger Card and Account are made available to eligible consumers by LendingClub Bank, N.A., Member FDIC, Equal Housing Lender ("LendingClub Bank"), in partnership with Challenger Finance Inc. (“Challenger”). Please read this Agreement carefully and retain it for future reference. If you sign the signature card or open or continue to use the Account, you agree to these rules. You will receive a separate schedule of rates, qualifying balances, and fees if they are not included in this document. If you have any questions, please email us at support@getchallenger.com.

This Agreement is subject to applicable federal laws, the laws of the state of Colorado, and other applicable rules such as the operating letters of the Federal Reserve Banks and payment processing system rules (except to the extent that this Agreement can and does vary such rules or laws). The body of state and federal law that governs our relationship with you, however, is too large and complex to be reproduced here.

The purpose of this document is to:

If any provision of this document is found to be unenforceable according to its terms, all remaining provisions will continue in full force and effect. We may permit some variations from our standard Agreement, but we must agree to any variation in writing either on the signature card for your account or in some other document. Nothing in this document is intended to vary our duty to act in good faith and with ordinary care when required by law.

As used in this document the words “we,” “our,” and “us” mean Challenger, our successors, partners, affiliates, or assignees, including LendingClub Bank. The words “you” and “your” mean the account holder and anyone else with the authority to deposit, withdraw, or exercise control over the funds in the account. The headings in this document are for convenience or reference only and will not govern the interpretation of the provisions. Unless it would be inconsistent to do so, words and phrases used in this document should be construed so the singular includes the plural and the plural includes the singular.

You agree, for yourself (and the person or entity you represent if you sign as a representative of another) to the terms of this account and the schedule of charges. You authorize us to deduct these charges, without notice to you, directly from the account balance as accrued. You will pay any additional reasonable charges for services you request which are not covered by this Agreement.

Each of you also agrees to be jointly and severally (individually) liable for any account shortage resulting from charges or potential overdrafts, whether caused by you or another with access to this account. This liability is due immediately, and can be deducted directly from the account balance whenever sufficient funds are available. You have no right to defer payment of this liability, and you are liable regardless of whether you signed the item or benefited from the charge or overdraft.

You will be liable for our costs as well as for our reasonable attorneys’ fees, to the extent permitted by law, whether incurred as a result of collection or in any other dispute involving your account. This includes, but is not limited to, disputes between you and a joint owner; you and an authorized signer or similar party; or a third party claiming an interest in your account. This also includes any action that you or a third party takes regarding the account that causes us, in good faith, to seek the advice of an attorney, whether or not we become involved in the dispute. All costs and attorneys’ fees can be deducted from your account when they are incurred, without notice to you.

The Account is a non-interest-bearing deposit account at LendingClub Bank. The Account is used to hold deposits, save, budget, make transfers to third parties, and spend using the Challenger Card. You can access the Account through Challenger’s mobile and web applications (the “App”). Please refer to Challenger’s Terms of Service for more information on the rules governing the App, services, website, and content.

We can open an account for individuals who are at least 18 years of age, are United States citizens or lawful residents of the United States, have a valid Tax Identification Number or Social Security Number, have a valid physical address in the United States or with military addresses (APO or FPO), are not currently on a government sanctions list, and who we decide to approve. The Account is only available to individuals and may not be used for business purposes or joint ownership/title.

We reserve the right to use third parties to help us decide if we should open your Account or not. We may decline to open an account to you for any reason, or no reason at all. We are not liable for any damages or liabilities resulting from our decision to refuse you an Account.

You must agree to accept paperless communication and maintain an up-to-date email address and contact information. You must agree to accept electronic delivery of all Account-related communications (including statements and tax documents).

You may apply for an Account through the App by providing and/or confirming accurate personal information. The App will ask for your legal name, date-of-birth, Social Security Number or Tax Identification Number, your physical address, and other information to verify your identity. In order to help the United States government fight criminal activities and terrorist financing, we will verify and record the identifying information of everyone who requests to open an account. Your account is not considered “opened” until we notify you that it is open.

There are no minimum deposit or minimum balance requirements to open an account. This Agreement does not create a fiduciary relationship or any other special relationship between you and us including as a financial advisor or trustee.

You may fund your Account as soon as it is opened. You may deposit funds by the methods described below. You may not deposit funds that are subject to any lien, claim, or encumbrance. You may only deposit funds that are immediately available under applicable law.

We reserve the right to adjust certain limits or impose holds on funds for specific account holders at our sole discretion. We do not accept deposits by mail.

Cash deposits at ATMs in the Allpoint+ surcharge-free Network or by other means are owned and operated by third parties who may impose additional fees at their discretion. Funds from any deposits made at ATMs that participate in the NYCE Shared Deposit Program (including Allpoint+) are usually available on the second business day after the day of deposit.

We make deposits available to your Account within a reasonable time after you make such deposits and such time may depend on your method of deposit. ACH transfers generally take a few days to settle. Deposits received on a business day after 3:30 PM Eastern Time or anytime on a non-business day will generally be considered received and available for withdrawal the second business day.

The above deposit methods may be unavailable or delayed from time to time due to eligibility requirements, scheduled maintenance, changes to our services, unforeseen circumstances, or outages. Challenger or LendingClub will give you reasonable notice if your access to feature changes or is no longer available to you unless such removal of access or cessation of services if due to your breach of this Agreement or your fraudulent or illegal activity in which case we reserve the right to immediately restrict or terminate your access to your account or the services without notice.

We may offer you provisional credit until collection is final for any items, other than cash, we accept for deposit (including items drawn “on us”). Before settlement of any item becomes final, we act only as your agent, regardless of the form of endorsement or lack of endorsement on the item and even though we provide you provisional credit for the item. We may reverse any provisional credit for items that are lost, stolen, or returned. Unless prohibited by law, we also reserve the right to charge back to your account the amount of any item deposited to your account or cashed for you which was initially paid by the payor bank and which is later returned to us due to an allegedly forged, unauthorized or missing endorsement, claim of alteration, encoding error or other problem which in our judgment justifies reversal of credit. You authorize us to attempt to collect previously returned items without giving you notice, and in attempting to collect we may permit the payor bank to hold an item beyond the midnight deadline. To process a deposit, we will verify and record the deposit, and credit the deposit to the account. If there are any discrepancies between the amounts shown on the itemized list of the deposit and the amount we determine to be the actual deposit, we will notify you of the discrepancy. You will be entitled to credit only for the actual deposit as determined by us.

We will treat and record all transactions received after our “daily cutoff time” on a business day we are open, or received on a day we are not open for business, as if initiated on the next business day that we are open. At our option, we may take an item for collection rather than for deposit.

Unless clearly indicated otherwise on the account records, any of you, acting alone, who signs to open the account or has authority to make withdrawals may withdraw or transfer all or any part of the account balance at any time. You may withdraw up to the amount of your current account balance unless you reach one of the limits described herein.

ATM withdrawals using the Allpoint surcharge-free network are free. However, other ATM networks may impose additional fees at their discretion. If you have received a direct deposit payment from your employer, we may increase your ATM withdrawal limits at our discretion.

We reserve the right, at our sole discretion, to impose additional limits, holds, or otherwise restrict any of the withdrawal methods listed above. If we suspect suspicious, fraudulent, or unlawful activity, we may stop transactions and may disclose transaction and Account information to regulators or law enforcement officials. You can ask us when you make a deposit when those funds will be available for withdrawal and if they’re subject to any holds or limits.

We do not permit you to overdraw your Account or overdraft. We do not charge overdraft fees or insufficient funds fees. If you authorize a transaction or withdrawal for an amount greater than your available balance, we can refuse to process or decline the transaction and notify you through the App. However, there may be instances where your Account can still be overdrawn such as if a deposit is returned or if a merchant settles a Challenger Card transaction for an amount greater than the card authorization. In the case any Account transaction is allowed or occurs which results in your Account balance becoming negative, you agree to immediately cure any such negative Account balance by promptly adding additional funds to your Account. We may close your account if you maintain a negative balance for more than thirty (30) days. We may, at any time and in our sole discretion, modify this Agreement to honor withdrawal requests that overdraw your account.

We try to make every deposit available promptly. For funds that are immediately available, which under applicable law are irreversible and are not subject to any lien, claim, or encumbrance, you will be able to withdraw up to your available balance. On a case-by-case basis, we may place a hold on a deposit or incoming transfer. If you will need the funds from a deposit right away, you should ask us when the funds will be available at support@getchallenger.com.

Please note that the Challenger Card may not be accepted at every merchant including any merchant that does not accept Mastercard.

On debit card purchases, merchants may request a temporary hold on your account for a specified sum of money, which may be more than the actual amount of your purchase. When this happens, our processing system cannot determine that the amount of the hold exceeds the actual amount of your purchase. This temporary hold, and the amount charged to your account, will eventually be adjusted to the actual amount of your purchase, but it may be up to three business days before the adjustment is made. Until the adjustment is made, the amount of funds in your account available for other transactions will be reduced by the amount of the temporary hold. If another transaction is presented for payment in an amount greater than the funds left after the deduction of the temporary hold amount, that transaction will be a non-sufficient funds (NSF) transaction if we do not pay it or an overdraft transaction if we do pay it. As an example, some merchants may request an authorization for the amount that they estimate you will spend and place a temporary hold for that amount. This estimated amount is likely to be different (either more or less) than the actual transaction amount. Typically, temporary holds are placed for up to three business days but exact times may vary. If a temporary hold is placed, please note that it may impact your available balance by an amount either more or less than you expected until the transaction posts. We are not responsible for damages or losses of any type, including wrongful dishonor, for any transaction that is not authorized or that is returned unpaid because of a hold or for any other reason.

An electronic check conversion transaction is a transaction where a check or similar item is converted into an electronic fund transfer as defined in the Electronic Fund Transfers regulation. In these types of transactions the check or similar item is either removed from circulation (truncated) or given back to you. As a result, we have no opportunity to review the check to examine the signatures on the item. You agree that, as to these or any items as to which we have no opportunity to examine the signatures, you waive any requirement of multiple signatures.

In addition, funds you deposit by mobile check deposit may be delayed for a longer period under the following circumstances:

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when the funds will be available. They will generally be available no later than the fifth business day after the day of your deposit.

This Agreement is subject to Article 4A of the Uniform Commercial Code. If you originate a fund transfer and you identify by name and number a beneficiary financial institution, an intermediary financial institution or a beneficiary, we and every receiving or beneficiary financial institution may rely on the identifying number to make payment. We may rely on the number even if it identifies a financial institution, person or account other than the one named. You agree to be bound by automated clearing house association rules. These rules provide, among other things, that payments made to you, or originated by you, are provisional until final settlement is made through a Federal Reserve Bank or payment is otherwise made as provided in Article 4A-403(a) of the Uniform Commercial Code. If we do not receive such payment, we are entitled to a refund from you in the amount credited to your account and the party originating such payment will not be considered to have paid the amount so credited. Credit entries may be made by ACH. If we receive a payment order to credit an account you have with us by wire or ACH, we are not required to give you any notice of the payment order or credit.

If you are a new customer, the following special rules will apply during the first thirty (30) days your account is open.

Funds from direct deposit to your account will generally be available on the day we receive the deposit.

Funds from wire transfers received before 4:00 P.M. Eastern Standard Time and the first $225 of a day’s total deposits of cashier’s, certified, teller’s, traveler’s, and federal, state and local government checks will be available on the first business day after the day of your deposit if the deposit meets certain conditions. The balance of funds up to $5,525 will be available on the second business day after the day of deposit. The excess over $5,525 will be available on the fifth business day after the day of your deposit.

Debit transactions are limited to $500 per day.

Funds from all other deposits including ATM, ACH, and mobile check deposits, including external transfers, will be available on the fifth business day after the day of your deposit.

If you receive a direct deposit from your employer, we may release you from these additional rules for new accounts.

If you wish to close your Account or terminate this Agreement, you may contact support at support@getchallenger.com. Closing our Account or termination of this Agreement does not affect our rights and obligations under this Agreement prior to Termination or your obligations under this Agreement prior to such Termination. We will tender your account balance to a linked account, by mail, or other reasonable means. You are responsible for leaving enough money in the Account to cover any outstanding or potential future transactions or debts.

We may close your account at any time with reasonable notice. Reasonable notice may differ depending on the circumstances, such as if fraud is suspected or we cannot verify your identity when it may be reasonable to give notice after restrictions or Account closure.

If your account is inactive for a period of time, it may be subject to escheatment. This means we will transfer your money/property to the corresponding state if no activity has been recorded for a given time dictated by state law. We will make a reasonable effort to contact you before we escheat your property. We will send your property to the state from your last recorded address, where it will be subject to those state laws. Funds transferred to the state can be recovered by filing a claim with the state.

We may modify or change any term in this Agreement at our sole discretion without notice by posting an updated Agreement on our website and/or in the App. All amendments are effective immediately. We will give you reasonable notice where applicable law requires. If you continue to use your Account after we notify you of an updated Agreement, you agree to the amended Agreement.

If you wish to opt-out of the updated terms, you may contact support@getchallenger.com to close your Account.

If we are required for any reason to reimburse the federal government for all or any portion of a benefit payment that was directly deposited into your Account, you authorize us to deduct the amount of our liability to the federal government from the Account without prior notice and at any time, except as prohibited by law. We may also use any other legal remedy to recover the amount of our liability.

If legal actions such as subpoena, restraining order, writ of attachment or execution, levy, garnishment, search warrant, or similar order relating to your Account (termed “legal action” in this section), we will comply with the legal action and may restrict or refuse withdrawals or transfers until we have clarity that the legal action is satisfied or dismissed. We will not contest on your behalf any legal process mentioned herein and may take action to comply with the local, county, state, or federal authorities as appropriate. We are not liable to you for any reason associated with the legal processes mentioned herein or damages if we must close your Account. You agree that you are responsible for any expenses incurred throughout any legal process, including legal fees we incur and will indemnify us of any losses.

You agree to accept electronic statements. We do not send paper statements. Statements are available through the App and/or sent to the email address we have on file. If you have transacted, withdrawn, or deposited funds in a statement period, you will receive a monthly statement. Otherwise, we will make a statement available at least quarterly. Please review statements carefully and notify us within sixty (60) days if you notice any errors. If you do not notify us in the allotted time, you may be responsible for unauthorized transactions as described in the section “Electronic Funds Transfers”. You agree to notify us if you did not receive a statement when you normally expect to receive it.

SPANISH LANGUAGE PREFERENCE

You agree that English is the controlling language governing your Challenger Account and your relationship with Challenger Finance Inc. If you select Spanish as your preferred language for your Challenger Account, you agree that we offer Spanish at your request for your convenience only. When you open an account, we may provide you with an unofficial Spanish translation of the Challenger App and Agreements governing your Account in addition to the official English version. If we do so, you should keep both the official English and unofficial Spanish versions for your records.

Certain features and services may not be available in Spanish including customer service availability by phone.

This Account may not be transferred or assigned without our prior written consent. However, we may assign our rights and obligations under this Agreement without your consent.

We allow you to link an account from a third party financial institution with your authorization through a third party service partner. We require that the linked account be titled in your name to transfer funds between your Account and the linked account.

The order in which items are paid is important if there is not enough money in your Account to pay all of the items that are presented. The payment order can affect the number of items returned unpaid. To assist you in managing your account, we are providing you with the following information regarding how we process those items.

ACH transactions are posted highest dollar amount to lowest. All other items, such as debit/ATM transactions and deposits are posted when received. Your available balance may not reflect every transaction that you or others have initiated as sometimes we do not always receive debits on the same day it is initiated.

If a check, item or transaction is presented without sufficient funds in your account to pay it, we will return the item for insufficient funds (NSF). We encourage you to make careful records and practice good account management. This will help you to avoid creating items without sufficient funds.

You agree that we may verify credit and employment history by any necessary means, including preparation of a credit report by a credit reporting agency or contacting your employer.

It is your responsibility to protect the account numbers and electronic access devices (e.g., an ATM card) we provide you for your Account. Do not discuss, compare, or share information about your Account information, password, or biometric data with anyone.

Your Account number can also be used to electronically remove money from your Account, and payment can be made from your Account even though you did not contact us directly and order the payment. Notify us immediately if you believe your Account has been compromised or stolen.

Except for consumer electronic funds transfers subject to Regulation E, you agree that if we offer you services appropriate for your Account to help identify and limit fraud or other unauthorized transactions against your Account, such as positive pay or commercially reasonable security procedures, and you reject those services, you will be responsible for any fraudulent or unauthorized transactions which could have been prevented by the services we offered, unless we acted in bad faith or to the extent our negligence contributed to the loss. If we offered you a commercially reasonable security procedure which you reject, you agree that you are responsible for any payment order, whether authorized or not, that we accept in compliance with an alternative security procedure that you have selected.

You are responsible for notifying us of any change in your address, name, email address, or phone number. Without up to date information, we may not be able to reach you and you may not be able to access your Account in the App. Unless we agree otherwise, your updated address or name must be sent to support@getchallenger.com or updated in the App. We will attempt to communicate with you only by use of the most recent address you have provided to us.

We may place a hold on the funds in your Account if it becomes subject to a claim adverse to (1) your own interest; (2) others claiming an interest as survivors or beneficiaries of your account; or (3) a claim arising by operation of law.

The hold may be placed for such period of time as we believe reasonably necessary to allow a legal proceeding to determine the merits of the claim or until we receive evidence satisfactory to us that the dispute has been resolved. We will not be liable for any items that are dishonored as a consequence of placing a hold on funds in your account for these reasons.

Restricted transactions as defined in Federal Reserve Regulation GG are prohibited from being processed through your Account with us. Restricted transactions generally include, but are not limited to, those in which credit or electronic funds transfers are knowingly accepted by gambling businesses in connection with the participation by others in unlawful Internet gambling.

To the extent permitted by law, you waive any notice of non-payment, dishonor or protest regarding any items credited to or charged against your Account. For example, if you deposit a check and it is returned unpaid or we receive a notice of nonpayment, we do not have to notify you unless required by federal Regulation CC or other law.

We may accept for deposit any item payable to you or your order, even if they are not endorsed by you. We may supply any missing endorsement(s) for any item we accept for deposit or collection, and you warrant that all endorsements are genuine.

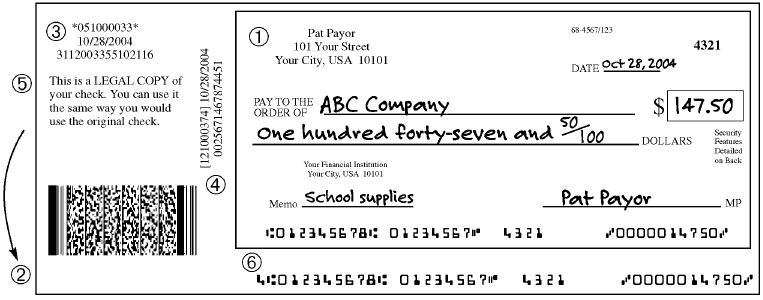

To ensure that your mobile check deposit (RDC) is processed without delay, you must endorse it (sign it on the back) in a specific area. Your entire endorsement (whether a signature or a stamp) along with any other endorsement information (e.g. additional endorsements, ID information, driver’s license number, etc.) must fall within 1 1/2″ of the “trailing edge” of a check. Endorsements must be made in blue or black ink, so that they are readable by automated check processing equipment.

As you look at the front of a check, the “trailing edge” is the left edge. When you flip the check over, be sure to keep all endorsement information within 1 1/2″ of that edge.

You agree that you will indemnify, defend, and hold us harmless for any loss, liability, damage or expense that occurs because your endorsement, another endorsement or information you have printed on the back of the check obscures our endorsement.

If you are an executor, appointed party, successor, designee, or appointed individual for the Account holder who has died or is adjudicated (determined by the appropriate official) incompetent, we are incredibly saddened by your loss. Please notify us immediately of the death or incompetence of the Account holder so we may take appropriate action. We may continue to honor instructions for the Account until: (a) we know of your death or adjudication of incompetence, and (b) we have had a reasonable opportunity to act on that knowledge. You agree that we may make transfers on or before the date of death or adjudication of incompetence for up to ten (10) days after your death or adjudication of incompetence unless ordered to stop payment by you. If we receive notification or if we have reason to believe that you have died or become incapacitated, we may place a hold on your Account and refuse all transactions until we know and have verified the identity of your successor. Your estate will be responsible for repaying us for any tax liability resulting from payment of your Account balance to your estate. You agree to hold us harmless for any actions we take based on our belief that you have died or become incapacitated, or any notices of death or incapacitation that we receive. If certain payments originating from government entities are deposited into your Account after your death, we may be required to return those payments to the originator upon notice.

Unless required by law or we have agreed otherwise in writing, we are not required to act upon instructions you give us via facsimile transmission or left by voice mail or on a telephone answering machine.

We may monitor or record phone calls for security reasons, to maintain a record and to ensure that you receive courteous and efficient service. You consent in advance to any such recording. We need not remind you of our recording before each phone conversation.

To provide you with the best possible service in our ongoing business relationship for your account, you agree to be contacted about your account from time to time by telephone, SMS, push notification, or email.

You authorize us to contact you regarding your Account through the communication information and channels that you provide to us. You further authorize us to contact you through the use of voice, voice mail, SMS, email, or push notification, including the use of pre-recorded or artificial voice messages and an automated dialing device.

If necessary, you may change any of the telephone numbers or email addresses, but we require an active mobile phone number and email to communicate with you about your Account.

If you claim a credit or refund because of a forgery, alteration, or any other unauthorized withdrawal, you agree to cooperate with us in the investigation of the loss, including giving us an affidavit containing whatever reasonable information we require concerning your account, the transaction, and the circumstances surrounding the loss. You will notify law enforcement authorities of any criminal act related to the claim of a lost, missing, or stolen Challenger Card or unauthorized withdrawals. We will have a reasonable period of time to investigate the facts and circumstances surrounding any claim of loss. Unless we have acted in bad faith, we will not be liable for special or consequential damages, including loss of profits or opportunity, or for attorneys’ fees incurred by you. You agree that you will not waive any rights you have to recover your loss against anyone who is obligated to repay, insure, or otherwise reimburse you for your loss. You will pursue your rights or, at our option, assign them to us so that we may pursue them. Our liability will be reduced by the amount you recover or are entitled to recover from these other sources.

Accounts may not be opened by a person acting in a fiduciary capacity unless otherwise approved by us in advance. A fiduciary is someone who is appointed to act on behalf of and for the benefit of another. We are not responsible for the actions of a fiduciary, including the misuse of funds. Only you, the Account owner, are authorized to access the Account.

Our business days are Monday through Friday, excluding federal or bank holidays.

LENDINGCLUB BANK, CHALLENGER FINANCE INC., AND ALL OF THEIR EMPLOYEES, CONTRACTORS, DIRECTORS, INVESTORS, SHAREHOLDERS, LICENSORS, PARTNERS, AND AGENTS (COLLECTIVELY, THE “THE RELATED PARTIES”) SHALL NOT BE LIABLE TO YOU OR ANY OTHER THIRD PARTY FOR ANY SPECIAL, INDIRECT, INCIDENTAL, CONSEQUENTIAL OR PUNITIVE DAMAGES (SUCH AS LOSS OF PROFITS, LOSS OF OPPORTUNITIES, LOSS OF GOODWILL, LOSS OF USE, LOSS OF DATA, BUSINESS INTERRUPTION, OR OTHER INTANGIBLE LOSSES) ARISING OUT OF OR RELATING IN ANY WAY WHATSOEVER TO THE APP, CHALLENGER CARD, SITE, OUR SERVICES, OUR CONTENT, ANY THIRD-PARTY MATERIALS, OR YOUR ACCOUNT.

EXCEPT AS EXPRESSLY PROHIBITED BY APPLICABLE LAW, IN NO EVENT WILL THE TOTAL LIABILITY OF THE RELATED PARTIES TO YOU FOR ALL CLAIMS ARISING OUT OF OR RELATING TO THE USE OF, OR ANY INABILITY TO USE ANY PORTION OF, THE SITE, OUR SERVICES, OUR CONTENT, OR THE THIRD-PARTY MATERIALS, WHETHER IN CONTRACT, TORT, OR OTHERWISE, EXCEED IN THE AGGREGATE SUM OF ONE HUNDRED UNITED STATES DOLLARS ($100.00).

SHOULD A COURT OF COMPETENT JURISDICTION FIND THAT ANY OF THE FOREGOING LIMITATIONS ARE INVALID, THE RELATED PARTIES’ TOTAL LIABILITY TO YOU FOR ALL DAMAGES, LOSSES, OR CAUSES OF ACTION OF ANY KIND OR NATURE WHATSOEVER SHALL BE LIMITED TO THE GREATEST EXTENT PERMITTED BY ALL APPLICABLE LAWS.

In exchange for and in consideration of us offering the App and services, you agree to defend us and any Related Parties, indemnify us and any Related Parties, and hold us and any Related Parties harmless from and against any and all suits, claims, losses, damages, expenses, demands, or liabilities, including attorneys' fees and costs, incurred by us or any Related Party in connection with any suit, regulatory action, or claim made by a third party arising out of or in any way related to: (1) your use of our App, any Challenger Card, our services, our content, any third party materials, or your Account; (2) your violation or alleged violation of these Terms or your violation or alleged violation of any applicable law or regulation; (3) your infringement or alleged infringement of any intellectual property or other right of any other person or entity; or (4) any dispute between you and a third party, including any provider of third party materials. You must not settle any such claim or matter without our prior written consent and we and the Related Parties reserve the right, at their own expense, to assume the exclusive defense and control of any matter subject to indemnification by you, and you further agree that you will cooperate fully in the defense of any such claims.

By using the App, Account, Challenger Card, or any of our services, you, your heirs and successors, and any business you may represent hereby agree and consent to resolving any and all disputes arising in any way whatsoever out of your use of the App, Challenger Card, services, content, any third party materials , or your Account by binding arbitration. The Federal Arbitration Act (“FAA”) shall govern the interpretation and enforcement of this provision. To be clear, this Agreement to arbitrate includes any and all claims arising out of or relating to any aspect whatsoever of this Agreement, the App, the Services, the Challenger Card, your Account, our content, any third party materials, this Agreement, our Privacy Policy, Challenger’s Terms of Service, and any applicable agreements, regardless of whether such claims are based in contract, tort, statute, fraud, misrepresentation, or any other legal theory, and regardless of when such a claim or claims arise, including any claims that may arise after you cease using the the App, the services, the Challenger Card, your Account, our content, or any third party materials. The arbitrator shall have exclusive authority to resolve any dispute relating to the interpretation, applicability, or enforceability of this binding arbitration agreement and provision. Notwithstanding the forgoing, this arbitration provision shall not be enforceable if otherwise not allowed by law.

BY USING THE SITE OR THE SERVICES YOU ARE AFFIRMING THAT YOU UNDERSTAND AND AGREE THAT BY USING THE SITE OR THE SERVICES, YOU, RADIUS BANK, AND CHALLENGER FINANCE INC. ARE EACH WAIVING THE RIGHT TO A TRIAL BY JURY OR TO PARTICIPATE IN A CLASS ACTION.

Arbitrations pursuant to the provisions contained in these Terms shall be governed by the FAA’s rules and procedures to the maximum extent they can be. If you wish to pursue arbitration against us, you must send us written notice of the dispute to the other by certified mail ("Notice") to [[address]]. To constitute valid notice, your Notice must (a) describe the legal nature and basis of any and all of your claims and disputes; and (b) set forth the specific relief which you seek. Following our receipt of your Notice, you agree to, for at least thirty (30) days work with us to find a good faith resolution. Any settlement negotiations that occur during this period shall not be disclosed to the arbitrator for the matter should we fail to reach a good faith resolution. The arbitration proceeding, the results of the arbitration, and any information, documents, or other discovery exchanged during the arbitration shall be confidential and you shall not disclose any of this to any third party without the prior written consent of Challenger. Any arbitration shall occur in Denver, Colorado at a mutually agreed upon location. The arbitrator shall have the authority to make rulings and resolve disputes as to the payment and reimbursement of legal and arbitration fees or expenses at any time during the proceeding and upon request from either party.

If any portion of this section labeled “ARBITRATION” (or this Agreement) is deemed invalid or unenforceable under any principle or provision of law or equity, it shall not invalidate the remaining portions of this section labeled “ARBITRATION”, this Agreement, or any prior agreement you may have had with us, each of which shall be enforceable regardless of such invalidity.

YOU, RADIUS BANK, AND CHALLENGER FINANCE INC. AGREE THAT EACH MAY BRING CLAIMS AGAINST THE OTHER ONLY IN YOUR OR ITS INDIVIDUAL CAPACITY AND NOT AS A PLAINTIFF OR A CLASS MEMBER IN ANY PURPORTED CLASS OR REPRESENTATIVE PROCEEDING.

Additionally, should an arbitration be initiated as set forth above, unless both you and Challenger agree to waive this provision, no arbitrator may consolidate more than one person's claims or otherwise preside over any form of a representative or class proceeding through such arbitration.

This Agreement shall be governed by the laws of the State of Colorado, excluding conflicts of law provisions. Further, if, and only if, the arbitration provisions contained herein be found unenforceable or, for whatever reason, you be allowed to pursue legal action outside of arbitration, you and Challenger hereby agree and consent to the exclusive personal jurisdiction of the state and federal courts situated within the County of Denver, State of Colorado for purposes of enforcing these Terms or litigating any other claim or cause of action you may wish to pursue against us and you hereby waive any objection that you might have to personal jurisdiction or venue in those courts.

Please read this disclosure carefully because it tells you your rights and obligations for the transactions listed. You should keep this notice for future reference.

Electronic Fund Transfers Initiated By Third Parties

You may authorize a third party to initiate electronic fund transfers between your Account and the third party’s account. These transfers to make or receive payment may be one-time occurrences or may recur as directed by you. These transfers may use the Automated Clearing House (ACH) or other payments network. In all cases, these third party transfers will require you to provide the third party with your account number and bank information. This information can be found in the App. Thus, you should only provide your bank and account information (whether over the phone, the Internet, or via some other method) to trusted third parties whom you have authorized to initiate these electronic fund transfers. Examples of these transfers include, but are not limited to:

You may access your Account through the App to:

You can limit withdrawals from ATMs by turning off your debit card in the App.

ATM Transfers

You may access your Account by ATM using your Challenger Card and your debit PIN to:

Some of these services may not be available at all terminals. Depending on the third party ATM owner or network, additional fees may apply. Please see the “Withdrawals” section for more limitations on ATM transfers.

Point-of-Sale ATM Card Transactions

You may withdraw cash from your Account at the Point-of-Sale machine (POS) at participating merchants in addition to your purchase ($500 limit per transaction; $2000 limit per month). You may be required to enter your PIN associated with your Challenger Card. The merchant may charge a fee for this transaction.

Currency Conversion and Cross-Border Transactions

If you effect a transaction with your Challenger Card in a currency other than US Dollars, Mastercard will convert the charge into a US Dollar amount. The Mastercard currency conversion procedure includes use of either a government-mandated exchange rate, or a wholesale exchange rate selected by Mastercard. The exchange rate Mastercard uses will be a rate in effect on the day the transaction is processed. This rate may differ from the rate in effect on the date of purchase or the date the transaction was posted to your account.

Mastercard charges us a Currency Conversion Assessment of 20 basis points (.2% of the transaction) for performing the currency conversion. In addition, Mastercard charges us an Issuer Cross-Border Assessment of 90 basis points (.9% of the transaction) on all cross-border transactions regardless of whether there is a currency conversion. As a result, we charge you a Currency Conversion fee of .2% and a Cross-Border Transaction fee of .9%. The Cross-Border Transaction fee is charged on all cross-border transactions regardless of whether there is a currency conversion. Across-border transaction is a transaction processed through the Global Clearing Management System or the Mastercard Debit Switch in which the country of the merchant is different than the country of the cardholder.

Illegal Use

You agree not to use your Challenger Card for illegal gambling or any other illegal purpose. Display of a payment card logo by, for example, an online merchant does not necessarily mean that transactions are lawful in all jurisdictions in which the cardholder may be located.

Banking with the Challenger App

You may access your Account through the Challenger web or mobile apps 24 hours a day using your login credentials to:

Limitations on frequency of transfers

In addition to those limitations on transfers elsewhere described, if any, the following limitations apply:

For security reasons, there are other limits on the number of transfers you can make by ATM.

For security reasons, there are other limits on the number of transfers you can make by debit card.

For security reasons, there are other limits on the number of transfers you can make through the App.

Bill Pay

We offer a Bill Pay feature that allows you to set recurring payments out of your Account to specified third parties or merchants. You can authorize this through the App as well as cancel a pre-authorized bill payment.

Liability for failure to make transfers

If we do not complete a transfer to or from your Account in the correct amount according to our Agreement with you and we are at fault, we will be liable for your losses or damages. Notwithstanding the forgoing, we will not be liable, for instance:

There may be other exceptions stated in our Agreements with you or permitted by law.

We will disclose information to third parties about your Account or the transfers you make:

If an unauthorized disclosure has been made, we must inform you of the particulars of the disclosure within three (3) days after we have discovered that an unauthorized disclosure has occurred.

Consumer Liability

Tell us IMMEDIATELY if you believe your Challenger Card and/or PIN has been lost or stolen, or if you believe that an electronic fund transfer has been made without your permission using information from your Account information. You should “lock” the Challenger Card in the App as soon as possible.

Also, if your statement shows transfers that you did not make, including those made by card, code or other means, tell us at once. If you do not tell us within 60 days after the statement was sent to you, you are liable for the losses of an unauthorized transaction.

Additional Limits on Liability for Challenger Card

You will not be liable for any unauthorized transactions using your Challenger Card if: (i) you can demonstrate that you have exercised reasonable care in safeguarding your card from the risk of loss or theft, (ii) upon becoming aware of a loss or theft, you promptly turned off the Card in the App and report the loss or theft to us, and (iii) you cooperate with us in pursuing recovery of the loss from any third-party.

Contact in Event of Unauthorized Transfer

Tell us IMMEDIATELY if you believe your Challenger Card and/or PIN has been lost or stolen, or if you believe that someone has transferred or may transfer money to or from your account without your permission using information from your Account information. You should “lock” the Challenger Card in the App as soon as possible. You can call or write us at support@getchallenger.com.

In case of errors or questions about your electronic transfers, call or write us at the telephone number or email listed in this Agreement as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt. We must hear from you no later than 60 days after we sent the FIRST statement on which the problem or error appeared.

We will determine whether an error occurred within 10 business days (20 business days if the transfer involved a New Account) after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days (90 days if the transfer involved a New Account, a point-of-sale transaction, or a foreign-initiated transfer) to investigate your complaint or question. If we decide to do this, we will credit your Account within 10 business days (20 business days if the transfer involved a New Account) for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your Account. Your Account is considered a “New Account” for the first 30 days after the first deposit is made, unless we tell you otherwise.

We will tell you the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation.

You may ask for copies of the documents that we used in our investigation.

As with all financial transactions, please exercise discretion when using an automated teller machine (ATM) or a night deposit facility. For your own safety, be careful. The following suggestions may be helpful.

[Marqeta Language]

When you open an Account, once approved, you will receive a Challenger Card (a debit card issued by LendingClub Bank under license by Mastercard International). Using your Challenger Card, you are able to make purchases up to your available balance subject to the limits set forth in this Agreement.

The Challenger Card is subject to the terms printed on the card including the expiration date, as well as all applicable rules and customers of any payment network, clearing house, or other associations involved in transactions in Addition to this Agreement. The Challenger Card is property of LendingClub Bank, must be surrendered upon demand, is nontransferable and may be revoked at any time without prior notice. Only you, the Account holder, is authorized to make purchases on your Challenger Card. If you give anyone else access to your Challenger Card, we will treat any transaction they initiate as authorized by you and you will be responsible for all transactions and fees that occur.

You can activate your Challenger Card in the App before it can be used. Please follow the instructions you receive in the mail along with your Card. Do not write down your PIN or share it with anyone. You may need to verify your identity to complete your activation request. You agree to sign the back of the Card immediately when you receive it and agree to the

Once activated, you may use your Challenger Card to make purchases anywhere where Mastercard is accepted. You may need to use your PIN to make purchases if Mastercard, Visa, Interlink, Maestro, Cirrus, MoneyPass, or Allpoint is displayed or accepted. Some merchants may allow you to perform a “split transaction” where you instruct the merchant to charge your Challenger Card an exact specified amount and pay the remaining amount by another method. Some merchants may decline to perform a “split transaction”, which could result in the charge being declined if you do not have sufficient funds.

You can use the information available on your Challenger Card to make purchases over the internet or by telephone, but keep in mind that these “Card-Not-Present” transactions are legally equivalent to using the plastic Challenger Card.

DIGITAL WALLETS

A digital wallet such as Apple Pay, Google Pay, or Samsung Pay let you make contactless purchases at POS systems and online. You can “add” your Challenger Card to your digital wallet by accepting the associated terms and conditions and following the instructions provided. By doing this, you agree to allow us to share your Challenger Card information with the digital wallet provider. Please protect your mobile device if you use a digital wallet as if it were your plastic debit card.

Your digital wallet may not be accepted everywhere. Your use of the Challenger card through your digital wallet remains subject to this Agreement. If you close your Account or if your Account is terminated, your Challenger will no longer function through your digital wallet. We are not the digital wallet provider, and cannot ensure the Challenger Card’s ongoing compatibility with any digital wallet. We are only responsible for honoring your request to share your Challenger Card information to allow you to use the digital wallet with the Challenger Card. The information we share with the digital wallet provider is subject to their terms and conditions as well as privacy policy. If you use the Challenger Card with your digital wallet, you agree and authorize us to collect, store, transmit, and use any transaction, merchant, location, and other data from the digital wallet provider about you, your use of the Challenger Card, and/or your mobile device.

You can withdraw cash from your Account from an ATM using your PIN. You will not be able to overdraw your account and may be subject to limitations disclosed in this Agreement. You will have access to surcharge-free ATM withdrawals from Allpoint ATMs, but may be charged a fee to your Account by any other ATM operator which is not controlled by us. Not all Point-of-Sale (“POS”) merchants will allow you to withdraw cash and may require a PIN.

You agree that we are not responsible for the quality, speed, delivery, safety, legality, or any other aspect of the products or services you purchase with your Challenger Card. If you want to return a product or dispute a transaction with a merchant you made on your Challenger Card, you must handle it exclusively with the merchant. If you are entitled to and are receiving a refund for a purchase on your Challenger Card, you agree to agree to the refund policy of the merchant and acknowledge that the funds may not be available for up to five (5) business days.

CARD REPLACEMENTS

To replace your card, please contact us through the App, by messaging us at support@getchallenger.com, or calling us. We may have to verify your identity before we send you a replacement.

Mastercard offers debit card holders certain benefits and privileges. Please visit Mastercard’s website for more information and contact them directly to engage.

The Account is not an interest-bearing account. No interest will be paid on deposits as APY.

There is no minimum balance requirement, but your Account will remain in “New Account Status” for thirty (30) days after you make an initial deposit

Challenger offers a variety of employee benefits programs; check with your employer to determine which program, if any, that you are enrolled. If your employer participates in one of Challenger’s employee benefits programs, your deposit account may be eligible for a reward in the form of a monetary contribution from Challenger directly into your account. The terms and conditions to receive this reward are defined further in this document. Challenger is not liable for your or anyone else’s tax liabilities based on this/these reward(s).

Challenger reserves the right to cancel or modify the terms of these programs, and/or terminate your eligibility at any time with or without prior notice.

We treat any information that we receive about you with a high degree of care and in accordance with all applicable laws and regulations governing the treatment of nonpublic personal information. Our privacy policy and disclosure is available on our web site at www.getchallenger.com/disclosures, or upon request.

Definitions

“Account holder” or “account holders” is/are the individual(s) named on the deposit account held by Challenger Finance Inc.

“Program year” means a consecutive 365-day interval beginning the day after an employer becomes a participating employer in one of Challenger’s employee benefit programs listed in Section 1 - Savings Programs.

“Direct deposit” means the electronic transfer of a payment directly to an account holder from the account of the payer.

“Employee” means an individual employed or independently contracted by a participating employer. An employee must be 18 years or older, and a citizen or resident alien of the United States with a valid U.S. taxpayer identification number.

“Employee benefit program” means the Savings Program listed in Table 1.

“Participating employer” or “participating employers” means employers that have contracted and are in good standing with Challenger Finance, Inc. for an employee benefits program.

“Reward” or “rewards” means a single, monetary direct deposit from Challenger to the saving space of an employee account holder. The reward originates from Challenger, not from a participating employer, and will be issued to the employee account holder by the end of the same calendar month that they qualify for the reward. A reward as defined herein may be referred to as a “match” or “bonus” in marketing materials.

“Saving space” refers to a sub-space classification within the deposit account held by the account holder(s) accessible by Challenger Finance Inc.’s mobile application.

“Separation” means the cessation of an employee/employer relationship. “Separation” also includes the end or unilateral termination of a service agreement between a participating employer and its independent contractor.

Eligibility Terms and Conditions:

To qualify for a reward under an employee benefits program, an account holder must be an employee of a participating employer. Account holders must enroll in direct deposit of at least a portion of their paycheck from the participating employer or set up another form of recurring transfer such as ACH from another bank account.

Section 1 - Savings Programs:

1k Savings Program - Employee account holders enrolled in the 1k Savings Program shall be entitled to a one-time reward of $100 once their Savings Program saving space reflects a balance of at least $900. Challenger will only consider contributions up to a maximum of $250 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

1k Savings Gold Program - Employee account holders enrolled in the 1k Savings Gold Program shall be entitled to a one-time reward of $100 when their Savings Program saving space reflects a balance of at least $900, and a one-time reward of $100 when their Savings Program savings space reflects a balance of at least $1900. Challenger will only consider contributions up to a maximum of $250 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

1k Savings Elite Program - Employee account holders enrolled in the 1k Savings Elite Program shall be entitled to a one-time reward of $100 when their Savings Program saving space reflects a balance of at least $900, a one-time reward of $100 when their Savings Program savings space reflects a balance of at least $1900, and a one-time reward of $100 when their Savings Program savings space reflects a balance of at least $2900. Challenger will only consider contributions up to a maximum of $250 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

1k Savings Platinum Program - Employee account holders enrolled in the 1k Savings Platinum Program shall be entitled to a one-time reward of $100 when their Savings Program saving space reflects a balance of at least $900, a one-time reward of $200 when their Savings Program savings space reflects a balance of at least $1800, and a one-time reward of $500 when their Savings Program savings space reflects a balance of at least $5000. Challenger will only consider contributions up to a maximum of $250 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

1k Savings Diamond Program - Employee account holders enrolled in the 1k Savings Diamond Program shall be entitled to a reward of $10 each month that they save at least $90 more than the balance from the previous month (i.e. they receive $10 for saving $90 in the first month, $10 for saving an additional $90 in the second month, etc.) up to a total of $100 in rewards per year. Employee account holders are eligible for these rewards as long as their employer is participating in the 1k Savings Diamond Program.

1k Savings Titanium Program - Employee account holders enrolled in the 1k Savings Titanium Program shall be entitled to a one-time reward of $50 when their Savings Program saving space reflects a balance of at least $450, and a one-time reward of $50 when their Savings Program savings space reflects a balance of at least $950. Challenger will only consider contributions up to a maximum of $250 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

1k Savings Titanium Plus Program - Employee account holders enrolled in the 1k Savings Titanium Plus Program shall be entitled to a one-time reward of $100 when their Savings Program saving space reflects a balance of at least $400, and a one-time reward of $100 when their Savings Program savings space reflects a balance of at least $900. Challenger will only consider contributions up to a maximum of $250 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

1k Savings Step Up Program - Employee account holders enrolled in the 1k Savings Step Up Program shall be entitled to a one-time reward of $10 when their Savings Program saving space reflects a balance of at least $90, a one-time reward of $100 when their Savings Program savings space reflects a balance of at least $900, and a one-time reward of $500 when their Savings Program savings space reflects a balance of at least $5000. Challenger will only consider contributions up to a maximum of $250 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

1k Savings Starter Program - Employee account holders enrolled in the 1k Savings Starter Program shall be entitled to a one-time reward of $20 once their Savings Program saving space reflects a balance of at least $200. Challenger will only consider contributions up to a maximum of $100 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

5k Savings Program - Employee account holders enrolled in the 5k Savings Program shall be entitled to a one-time reward of $100 once their Savings Program saving space reflects a balance of at least $4900. Challenger will only consider contributions up to a maximum of $1000 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

5k Savings Gold Program - Employee account holders enrolled in the 5k Savings Gold Program shall be entitled to a one-time reward of $500 once their Savings Program saving space reflects a balance of at least $4500. Challenger will only consider contributions up to a maximum of $1000 a month to employee account holder’s Savings Program saving space; any other deposits or contributions over this amount are not calculated to determine an employee account holder’s eligibility for a reward.

There is no periodic or conditional renewal of an employee account holder’s eligibility for (a) reward(s) but for a participating employer’s enrollment in a multi-year employee benefits program. If a participating employer is enrolled in a multi-year employee benefit program, employee account holders may qualify for (a) reward(s) from their Savings Program once per program year.

An account holder is only eligible for (a) reward(s) while an employee of a participating employer. If an account holder is separated from their employment with their participating employer, or the participating employer terminates its agreement with Challenger for an employee benefits program, the account holder will still have access to their deposit account(s), but may no longer be eligible for (a) reward(s), regardless of whether they otherwise meet the minimum requirements of any employee benefit program. There are no service charges for account holders to maintain a deposit account with Challenger and no overdraft fees. There are no transactional limits but for the contribution limits set forth in Section 1 - Savings Programs to qualify for a reward.

Rewards are issued and paid for by Challenger, not your or anyone else’s participating employer. Account holders are responsible for tax liabilities created by rewards. Challenger will issue the account holder the appropriate tax documents (1099-INT, 1099-MISC) in accordance with State and Federal law to reflect the reward(s) issued to the account holder during the calendar year. Challenger is not a tax advisor.